Contributed by Maude Delice

I travel to Japan a lot. Like many millennials, I’m obsessed with vintage finds, great food, and anime culture.

On my last trip, I stayed in Fukuoka, the rumored birthplace of Miyamoto Musashi—the legendary samurai known for never losing a duel (some historical accounts cite over 60 victories) and, in certain stories, defeating multiple opponents at once.

Musashi was obsessed with mastery and constantly chasing perfection. He’s become the patron saint of high standards: part inner critic, part disciplined strategist. That part I already knew.

What I didn’t know, until I finally picked up The Book of Five Rings in Japan, is that his philosophical treatise is considered a cult classic in business circles. It’s frequently name-dropped by executives and strategy types. So if you’re looking for the “stamp of credibility” to explore a 17th-century samurai’s mindset, consider it stamped.

I never thought a swordsman would become one of my IR role models. But here we are.

And where is here, exactly?

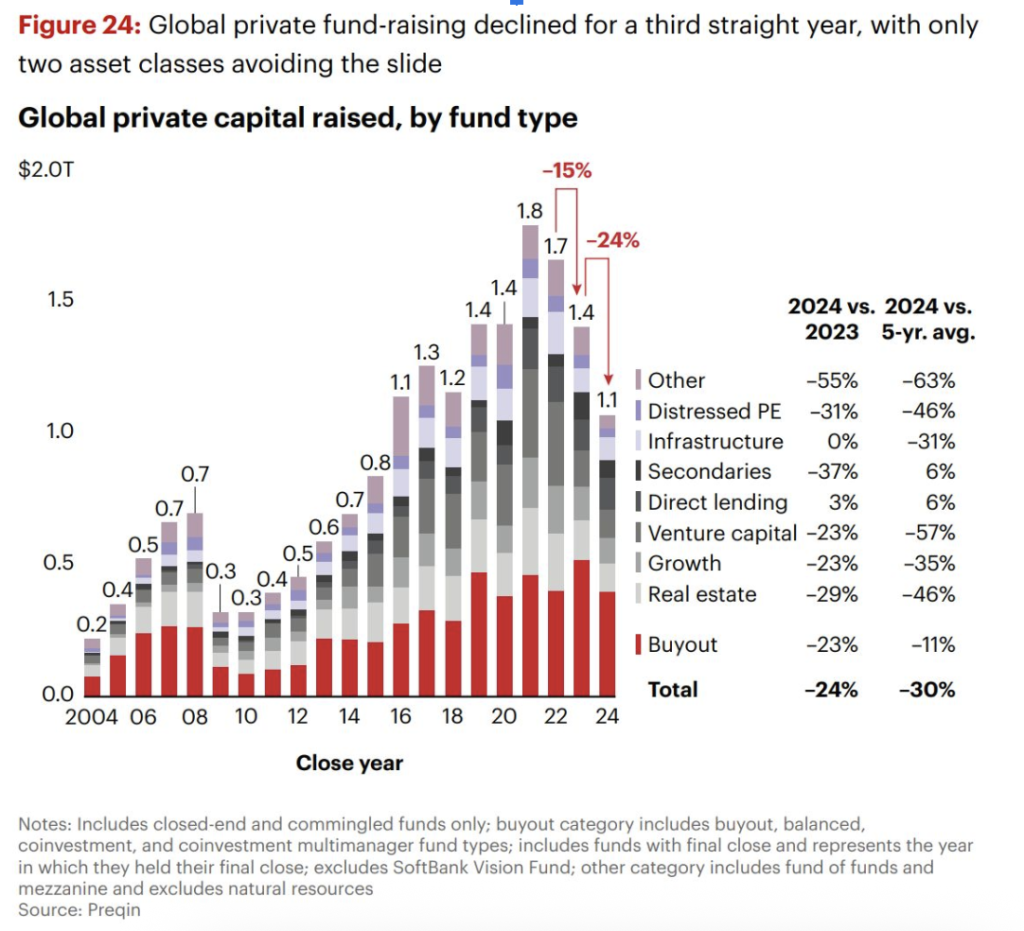

According to Bain & Company’s 2025 Global Private Equity Report, fundraising is down for the third year in a row. Global private capital raised: $1.1T in 2024. That’s a 24% YoY drop and 40% off the 2021 peak. The median time to close is now hovering around 20 months. Venture capital was among the hardest-hit strategies, down 23 percent year-over-year and 57 percent below its five-year average.

Hamilton Lane calls this fundraising market a secular shift, not a cyclical one. Capital formation hasn’t just slowed. It has been reshaped. Sub-$1 billion funds are struggling to stay in the game, the middle market is getting squeezed, and consolidation with larger firms is accelerating.

Large allocators like CalSTRS and CalPERS have doubled down on the collaborative allocation model by expanding internal teams to pursue direct deals, co-investments, and secondaries alongside managers rather than through them.

If you’re in IR today, you’re managing macro headwinds, internal expectations, new external dynamics, and institutional fatigue, all while trying to stand out in an oversaturated, overallocated market.

Strategy, timing, clarity, and control over your emotions matter more than ever. And that’s where Musashi comes in.

1.“Whatever the case, train diligently to forge a spirit that seeks victory through the application of strategic wisdom.”

I was once handed a list of LP targets that had everyone and their mama on it. We call this the “spray and pray” strategy. At the time, the GP chose not to invest in a data platform that would provide updated intel on actual LP activity.

This is not a strategy. It is noise.

According to Bain & Company, firms that are investing in their IR platforms and equipping teams with better data are outperforming peers in some cases by two to three times the AUM.

Modernizing your approach means recognizing that capital formation today is enterprise sales. Competitive pressure is rising, and capital won’t flow to managers who ignore performance signals or client needs. More managers are investing in real-time tech, valuation tools, and infrastructure. Once LPs see what best-in-class looks like, they’ll expect it across the board. The managers who can’t keep up won’t just lose capital. They’ll lose relevance.

2. “One must also be able to energize momentum in the project and know limitations.”

Not all advice is equal, but if the market is consistently telling you something, you need to learn how to listen. I once struggled to gain traction with a fund positioning itself as impact. I checked in with a few trusted LP relationships to better understand market sentiment. Most expressed skepticism about the fund’s impact positioning, while the GP remained confident in their thesis and considered publishing an impact report to help clarify the narrative.

I made it clear that publishing the report would be a mistake, because the signal it would send to LPs was obvious: we are not listening. And in this business, the LP is the customer, and the customer is always…

Knowing your limitations, adjusting with intention, and understanding how you are perceived in the market is what builds trust. That is what earns you credibility.

3. “Traversing problematic positions is also necessary at many junctures during a man’s life. With sea routes, you must know the hazardous places that need crossing, know the conditions of your vessel, and know well the lucky or unlucky omens of each day.”

Last year, the running mantra in the IR community was: “2025 is the year we thrive.”

Hello, 2025. It’s me again, Maude. Are we thriving yet? Because so far, it still feels like we’re paddling upstream with a cracked oar, in freezing water, on a makeshift door—and Rose still won’t scoot over.

If you think IR is only relevant during fundraising, think again. This is when you need someone in the seat who knows how to steer through tough conditions, especially if your returns are underwhelming.

To win in this market, GPs must approach capital formation across three key fronts:

- Know the hazardous places that need crossing aka Investor Relations: Identify and manage the pressure points in your LP relationships. Serve and retain through transparency, consistency, and responsiveness.

- Know the condition of your vessel aka Product Management: Understand your pacing, exits, and liquidity. If you’re in the market, make sure you’re right-sizing your strategy to align with LP expectations and market realities. And remember what I said in #2: active listening.

- Know the omens of each day aka Strategic Positioning: Stay attuned to how the market is moving. Let’s be clear: just because X fund is raising doesn’t mean you will. If you enter the market without context, LPs will assume you haven’t done your homework. Build credibility and visibility with thought leadership, thematic insights, and relevant engagement.

4.“It is of utmost importance for a warrior to see distant things as if they were close and close things as if they were distant.”

While institutional capital will continue to grow, sovereign wealth funds and private wealth will drive the next wave of growth in alternatives. That’s the long view, and it is coming into focus fast.

At the same time, LPs are increasingly moving away from traditional blind pools to vehicles that offer flexibility, transparency, and better alignment with LP needs.

According to StepStone, the average ratio of co-investment capital to fund size is 1:5—that’s $1 in co-invest for every $5 in fund capital. PitchBook reports that co-investment vehicles with PE managers raised $33.2B globally in 2024—the highest total in over a decade. Co-investment is no longer a nice-to-have—it’s a sales tool. LPs want access, alignment, and meaningful participation.

Gaining an edge now means adapting to what is coming, not just what is here. That means investing in fund structures, messaging, and relationships that reflect this next generation of capital. Seeing distant things as if they were close is not philosophy. It is foresight.

5. “With no understanding of the [deeper] principles of strategy, they seek to win from a safer distance with a longer weapon. This is indicative of a weak mind and is why I see their strategies as being feeble.”

In IR, a longer weapon looks like a glossy pitch deck, and the belief that performance alone will carry the story. But differentiation is not just about returns. It is about how you communicate your unique value in a crowded market.

Legacy is achievement. Brand is influence. The firms that win understand this and act accordingly.

I remember making the case for more consistent touchpoints to help us stay top of mind with our relationships. At the time, the GP leaned toward a more reserved communication approach. But in a long sales cycle, staying visible and engaged is essential.

LPs don’t build conviction from a single meeting. They build it over time. Firms that stay top of mind aren’t louder. They are more consistent, more clear, and provide more meaningful engagement.

If you don’t equip investors with insight into how you generate ideas, how you execute, and how you deliver on your promise, it becomes harder for them to articulate what sets you apart. And if they can’t articulate your value, they won’t remember you. If they don’t remember you, they won’t back you.

Relying on legacy alone to carry the story is a bit like using a long sword just for the sake of reach. It might feel safe, but it can keep you at a distance. Real strategy brings you closer to your LPs with clarity, purpose, and connection.

Final Thought – The Modern Warrior’s Mindset

Musashi writes, “there are stances, but there is no stance.” In other words, the best strategy is not fixed, it is responsive. IR, too, requires that kind of mental flexibility. Embracing a scout mindset, one that prioritizes exploration over certainty, has helped me navigate one of the most challenging fundraising environments the industry has seen. The relationships and lessons I’ve built during this time continue to prove their value, reinforcing the value of vision, morale, and a cohesive team to weather change.

In the end, that is the essence of Musashi’s teachings: discipline in the face of difficulty, resilience when the path ahead is unclear, and the ability to adapt with strategic clarity.

Arigato, Musashi.

(P.S. If you’re more of a manga reader than a military strategist, Vagabond by Takehiko Inoue hits just as hard.)

The post 5 Things a 17th Century Samurai Taught Me About Investor Relations appeared first on SHOPPE BLACK.